Training Course

You are at risk. Fight back against fraud.

Corporates are under attack.

Treasurers must respond.

With fraud on the rise, corporate coffers are being targeted by increasingly sophisticated criminals. One of the best ways to protect your organization is to educate your people.

It is growing in frequency and complexity. Criminal payouts are greater than ever.

If your firm is not currently under attack, it is certainly under surveillance.

Defend yourself against the risk of critical loss. Know how to spot fraud attacks.

Awareness

Knowledge

Prevention

Mitigation

New Profit of Payment Fraud

Mapping the Battlefield

Treasury Security Framework – Company View

Treasury Security Framework – Treasury View

Key Security Policy Points

Common Fraud Types Defined

Fraud in Action: Bangladesh

The Criminal Playbook

The 12 Security Principles - Parts 1 & 2

Improve your ability to understand the security frameworks at your organization by implementing these key principles. Walk through control steps with each principle and discover the applicablility to all employees at your organization.

Office, Desktop, and Email Security Practices

Commonly overlooked, these everyday practices mitigate potential violations, which if left undiscovered can expose confidential information and create avenues for criminals to access your organization’s data, systems, and facilities.

focused on treasury.

(blocks of 10)

across departments.

(blocks of 25)

regional or global reach.

(blocks of 50)

for global organizations.

Access

Custom Policy Video (Swift CSP)

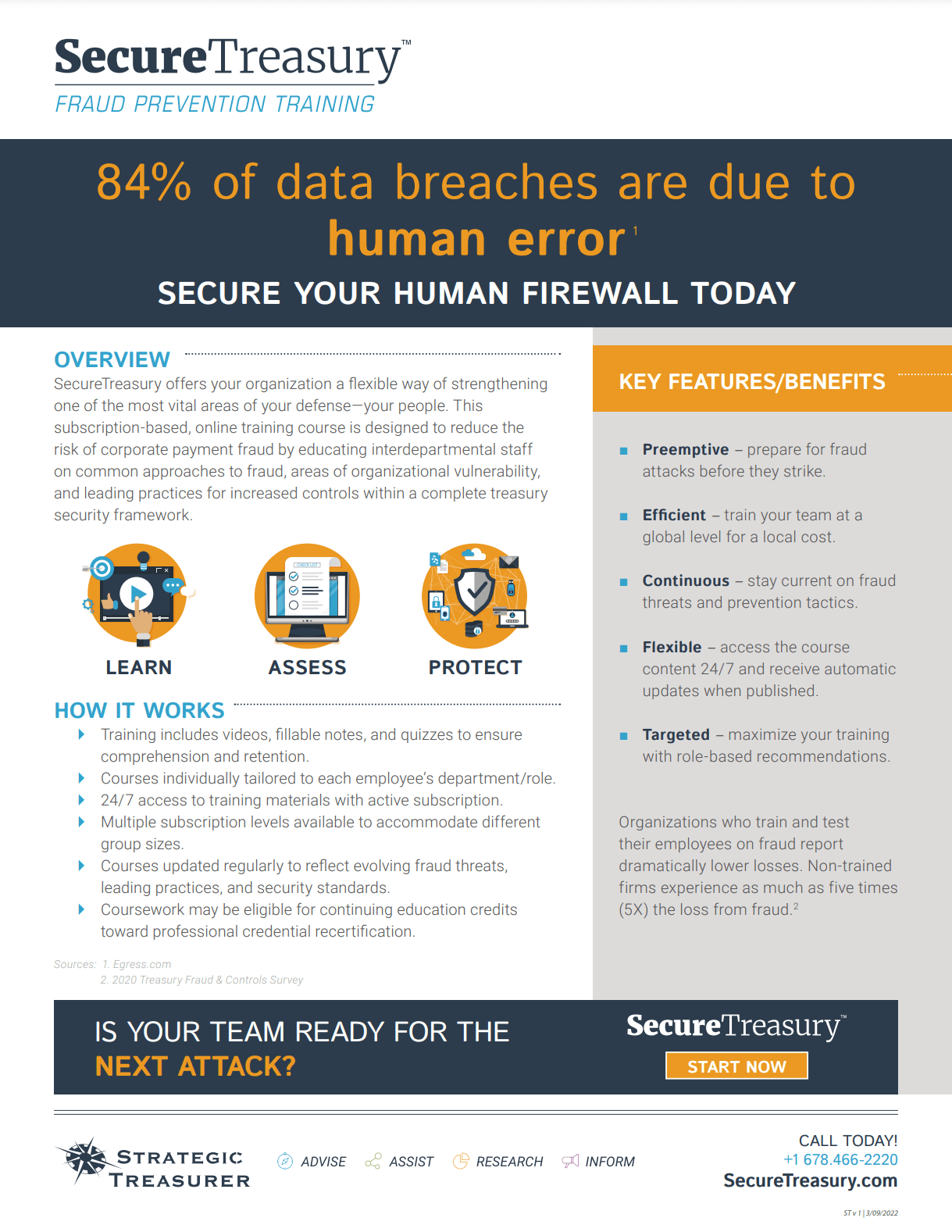

SecureTreasury™ is a professional training program designed to reduce the risk of payment fraud in corporate and banking institutions by educating interdepartmental staff on common approaches to fraud, areas of organizational vulnerability, and leading practices for increased controls within the context of a complete treasury security framework.

Strategic Treasurer is a top tier consultancy in the areas of security, technology, and compliance. Corporate clients, banks, and fintech providers all rely on their industry leading advisory services which are backed by a deep awareness of current practices, plans, and perceptions through annual industry surveys and decades of treasury experience.

Secure Treasury™ Training. © 2021 Strategic Treasurer. All Rights Reserved.